Yoguely is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

How Interest Rates Affect Inflation

Ready to optimize your market timing and keep more of your gains?

Awesome!

In this post, you’re going to see one of my favorite key economic indicators in action.

Interest Rates

Specifically, I’ll show you how I use interest rates to to gauge the economy and brainstorm the possibilities of where the markets might be headed.

Let’s get started!

There Is No One Simple Rule

Understanding finance is imperative if you want to keep most of your hard earned money. We’ll be covering a lot of ground so that you don’t have to repeat the mistakes of the past.

And even if you grasp this one concept really well, there are a lot of other forces that will affect whether your wealth goes up or down.

The most foolish thing you can do is over simplify concepts into rules that sound intelligent but if you do a little history research it actually doesn’t make any sense.

That is why, when it comes to the broad markets, predicting whether an index of 500 companies or 1000 companies will rise or fall, is a lost cause if you are solely looking at the Fed’s interest rates for your predictions.

The most prudent prediction, is no prediction. You could be right, you could be wrong. Only time will tell if it was due to skill or due to luck. So just be prepared for either scenario to play out, up or down.

So first, a little background on inflation and the Fed.

Inflation is Everywhere

Throughout history, wherever there has been money, inflation has come with it.

Which countries have undergone severe inflation?

Babylon, Ancient China, England, France, Germany, Argentina, Venezuela, the United States, and pretty much the entire world has experienced inflation. History has shown that the increase in the money supply, and rising prices is the norm, and by no means a special case scenario. And interestingly, the larger the economic system, the more intertwined with daily living, the more insane inflation becomes.

How insane can inflation get?

When I say insane, I’m referring to the kind of inflation that seizes wealth and sparks revolutions. No one is except from it. Every person is touched by inflation, its the melody that dictates our net worth, our spending and our savings.

To this day governments communicate things like “this time is different” as they recklessly issue new currency into circulation. But the truth is the basic mechanics of inflation hasn’t changed, and neither has their effects.

Society has become completely dependent on using money to exchange for the necessities of every day life. We don’t walk around with one thousand bikes to trade for a house, we use cash for that.

The Federal Reserve Bank

Who issues money in the US?

For the last hundred years it’s been the Federal Reserve Bank. That’s right they are the guardian of the money supply. They were put in place in 1914 with the idea that it would be an economic stabilizer. Ridding the country of inflation and economic crises.

Of course, history shows many crises and inflationary periods since then. Including the Wall Street Crash of 1929, the recession of 1973 where high unemployment and high inflation coexisted, the bursting of the Dot-com bubble in the 2000, and the global financial crisis of 2008.

The Federal Reserve Bank is not federal, it’s not an agency of the US government. It’s a private corporation with the power to control the money supply. And with this power they can financially engineer booms and busts when desired.

Interest Rate Control

How does the Fed increase the money supply?

Well the first monetary policy tool the Fed reaches for is interest rate control. Just recently, the Fed decreased interest rates from 1.58% in February 2020 to 0.08% today in September 2021.

So if you are wondering, what is the Federal Reserve interest today?

You are in luck because all the raw data is publicly available from the Board of Governors of the Federal Reserve System. If you are more of a visual person like me, the St Louis Fed website is the place to go to view really nice graphs with the data.

Effective Federal Funds Rate Chart

This is the Effective Federal Funds Rate chart. The federal funds rate is the interest rate at which banks lends their excess cash to other banks overnight. It is influenced by the Federal Reserve Bank who meets 8 times a year to determine the federal funds target rate.

Here the X-Axis is the year from 1955 to today and the Y-Axis is the percentage interest rate. Here are a few VERY interesting things to note:

First, we are in an extremely low interest environment. Even back in July 1954 it was at at 0.80%, ten times higher than today.

These grey shaded areas represents periods of recessions.

What is a recession?

It’s periods where economic activity is contracted. Basically costs are cut, companies lay off workers, and trade and industrial activity is reduced.

Those periods of recessions were triggered in part by the rising interest rates, which made it much more difficult to borrow money.

Just look at this, in October 1957 the interest rates reached a peak and the economy entered a recession. Then the fed dropped the interest rates and began to increase it only to trigger another recession in April 1960.

Then the US had one of the longest bull markets in history, from 1962 to 1969, lasting roughly 7 years and having had an increase of 70% in the Dow Jones index. Only for the economy to have gotten too hot, crashing the Dow index 35% in 1 year.

What did the Fed do in the crash of 1969?

When the markets crashed, the Fed tried to come to the rescue by doing what they usually do, decrease interest rates which ones again jump started another bull market.

But inflation was running too hot so the Fed had to increase rates, which once again crashed the Dow index by 44% in 1974. The fed pulled the emergency brakes on the interest rates but then had to rapidly increase it to stop the United States from spiraling into hyperinflation.

How high did interest rates get in the 1970s?

Interest Rates hit the highest in history, 19.04% in July 1981.

Keep in mind that the federal funds rate spills into other forms of credit, affecting the entire economy. For instance, if you want to take out a business loan, or an auto loan, or a house loan. Everyone is affected by the Fed’ s policies.

Just imagine going out to buy a house on credit in the year 1980, and being offered an 18% yearly interest rate on the loan. Isn’t that INSANE? That is just unbearable.

How has interest rates behaved since the 1980’s?

Ever since 1981, the Effective Federal Funds Rate has been declining steadily. Any time the fed tries to increase rates, it triggers a recession. But hey the Fed knows well how to shorten the recessions, just pull the interest rates down. Like here in 1989, 2000, and 2007.

The Fed had been trying to raise interest rates to stop inflation from getting too hot. Because if inflation gets out of control that would mean the collapse of the dollar as we know it.

People would loose trust in it and start wanting to get rid of it. So they’d trade the cash for any asset they can find, making inflation worse and worse. If you are still a sleepy camarón, you’ll wake up to find that you’ve been priced out!

That house you wanted to buy? Nope, can’t do it, it’s double the price. Instead of prices increasing 2% a year, it’s 2% a month. And the more people rush to get rid of cash, the faster inflation can take over. Perhaps increase in prices of 2% a day, or 2% an hour. All those are completely possible scenarios. You can’t say it can’t happen to you.

Look here at the graph from 2006 to 2021. Interest rates were darn low since the collapse of the housing market in 2007-2008.

After a long recession, interest rates had been steadily climbing from 0.12% in November 2015 to 2.40% in July 2019. Only to be pulled down to 1.55% November 2019.

This was due to a sudden spike in the repo rates, which we can talk more about another time if you like, just let me know in a comment below.

From November 2019, the Fed Funds rate was pretty steady until February 2020 when the Fed dropped it to 0.05% over the next 3 months until April 2020. It has been hovering low since then.

So, what consequences has low interest rates brought us today?

An everything bubble.

Tech, houses, crypto, commodities, you name it.

Hold on, what are commodities?

Most commodities are basic raw materials that are used to make other goods.

When money is first injected into the economy, it creates a high demand for stuff. Since it takes a while for prices to adjust to the new money, goods get bought out fast, creating shortages.

Shortages means that the price is not high enough. So for supply to meet demand, the prices of most things have been steadily increasing over time.

How can you tell if commodities have been going up?

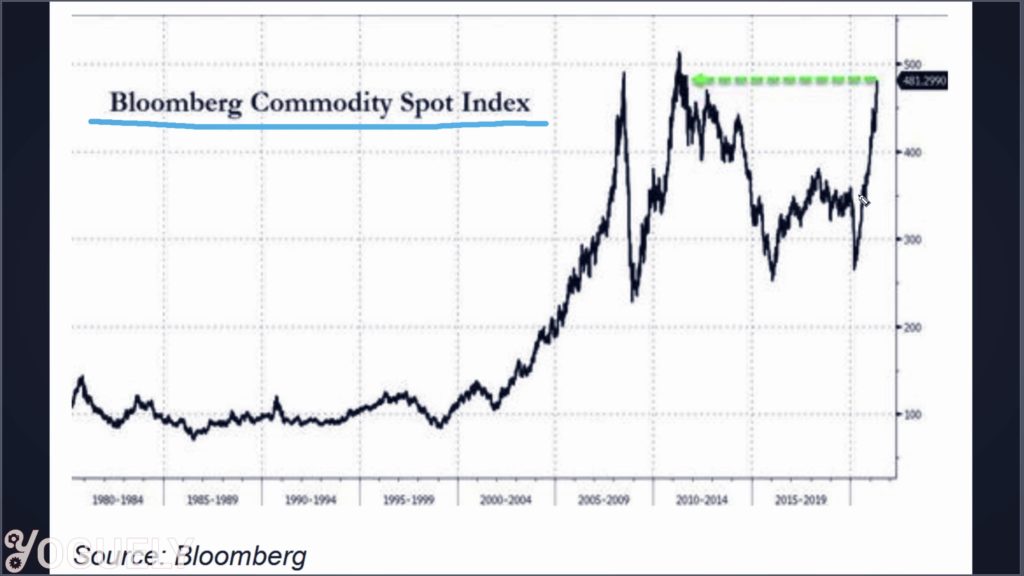

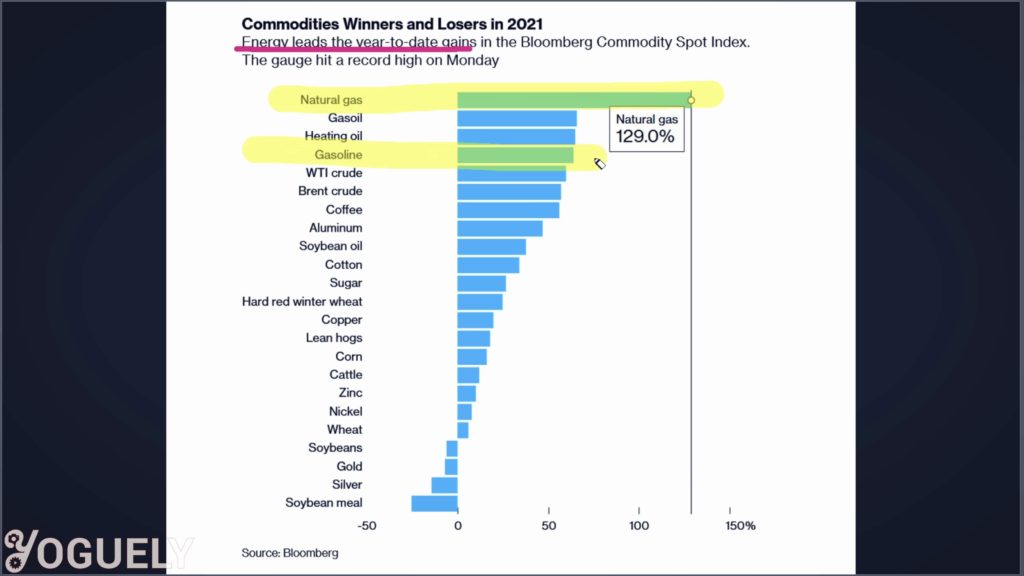

Take a look at Bloomberg’s Commodity Spot Index. This index tracks 23 energy, metals, and crop futures contracts.

How are the low interest rates affecting commodities?

The Commodity Spot index is increasing at a record pace, in fact it is up 62% Year-over-Year, the fastest since January 1980.

This is why things have been out of stock. Bidding wars on homes are a thing now. And hard to get video cards are being resold at higher prices only.

Energy is one of the most important commodities in the world, and it is at the top among the winners in inflation Year-over-Year. Natural gas has gone up 129% and gasoline 64%.

This relationship between commodities, energy, and money supply is nothing new. And we can definitely learn from history to take some self-defense measures to preserve our wealth.

Yoguely, I get it, interest rates are insanely low.

But, how will interest rates change in the future?

I fear that we are going to have one of the biggest interest rate squeezes yet. Just look, the rate has nowhere to go but up. The Fed has spoken that they plan to increase it is soon.

How soon will the Fed hike interest rates?

Maybe this year, maybe next year. It’s subject to change. But when it does hike, it’s going to make borrowing money insanely expensive. People will have to be more frugal about whether to use leverage in their investments and speculations.

Heck, people are so overconfident that the markets only go up, that some are buying the index on leverage, on borrowed money, making the index even more overvalued. If for some reason all these people get squeezed and have to sell, it’s gonna be a severe decline. And declines can last a long time.

You wouldn’t want to be waiting 10 years to get your money back without a loss, but also without having made any gains.

How do rising interest rates affect growth companies?

Growth companies tend to be highly leveraged companies, that depend on access to easy credit to attain fast growth. Those growth companies, like technology companies have historically shown how vulnerable they are to interest rate increases.

Take a peek at the NASDAQ 100 index, the stock market index that is heavily weighted towards information technology companies.

The NASDAQ 100 has been going up full force since the Fed’s March 2020 monetary injection. And now with the Fed talking about toning down the money printing, the NASDAQ-100 has been having a rocky decline downwards.

If the Fed keeps rates low for too long, inflation will debase the dollar. And if the Fed increase rates, the stock of overvalued companies will be crushed, affecting people’s savings and retirement plans.

What we can do now is protect ourselves against either possibility.

Conclusion

So that is how to use interest rates to predict the market.

In my next post, find out which “money printer” is most inflationary, QE or Helicopter Money.

Now I’d like to hear what you have to say: how have the recent interest rate drop affected your financial decisions?

Let me know by dropping a quick comment below right now.

I’m Aida Yoguely. Thanks for learning with me today. And I’ll see you again in the next one. That’s all folks.

Video

Be sure to subscribe and hit the notification bell to stay tuned for the latest videos.

References

St Louis Fed Fed Funds

St Louis Fed 30-Year Fixed Rate Mortgage Average in the United States

- Why Helicopter Money Is Inflationary - 2021-10-09

- How Interest Rates Affect Inflation - 2021-10-08

- How Long Has Inflation Existed? - 2021-10-01