Yoguely is reader-supported. When you buy through links on our site, we may earn an affiliate commission. Learn more

How to Do Your Own Taxes for FREE Online

Today, I’m going to teach you exactly how to do your own taxes for free and easy online.

It is the exact process I use every year to file my own taxes super easily online for no cost.

So if you want to avoid paying to file taxes, you’ll love this guide.

Let’s get started.

Do I Have to Pay to File Taxes?

Paying for tax filing software is easy, and so is hiring a tax preparer to do it for you. But earning enough money to sustain such high expenses, year after year, is hard work.

Online filing software can cost around $90 for a federal return if you have investments, plus around $50 for each state return.

That means that over the course of your lifetime you could be loosing upwards of $21,373. This assumes an opportunity cost of investing that money annually at a 4% rate of return for 50 years of your life.

Determined by calculating the future value ![]() of an annuity invested at an interest rate

of an annuity invested at an interest rate ![]() for

for ![]() years, given the value of each annuity payment

years, given the value of each annuity payment ![]() .

.

(1) ![]()

But did you know that for many people, this is an unnecessary expense?

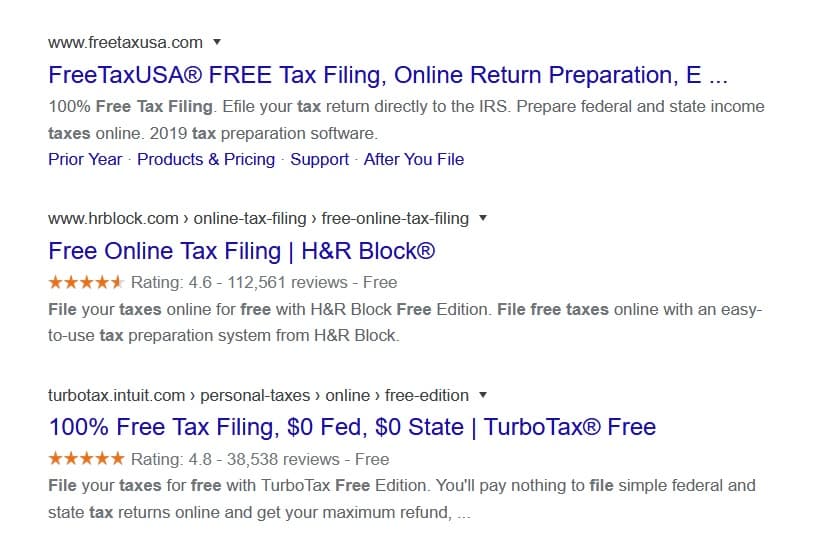

Most people try to find, “what is the cheapest tax software?

or

“which tax preparer can give me the lowest quote?”

But for Yoguely, we are all about cutting down expenses down to nothing.

So we ask:

“Do I have to pay to file taxes at all? Can I do my own taxes for free?”

No, you don’t have to pay to file taxes. Yes, you can do your own taxes for free.

The truth businesses don’t want you to hear is, there are free alternatives.

I’ll teach you how to do it yourself so that you can save money and build wealth faster.

I Was Tricked into Paying to File My Taxes

I’ll be frank with you; I fell for it too.

During college, I was so stressed about getting back to studying that the only thing in my mind was “How can I get my taxes done FAST?”

I clicked on a link that said “Free Tax Filing”.

Then I started inputting all my personal information only to find out that I didn’t qualify for free filing. Because I needed an extra form not included in the free version.

BOOM. Pay big $ to upgrade.

Over the course of a 7 year university degree, that cost can amount to over $1000 on online tax filing software, computed using equation (1). Even more than that if you are like me and interned in a different state ever year.

That means needing to file two state tax returns yearly! A fortune for a college student.

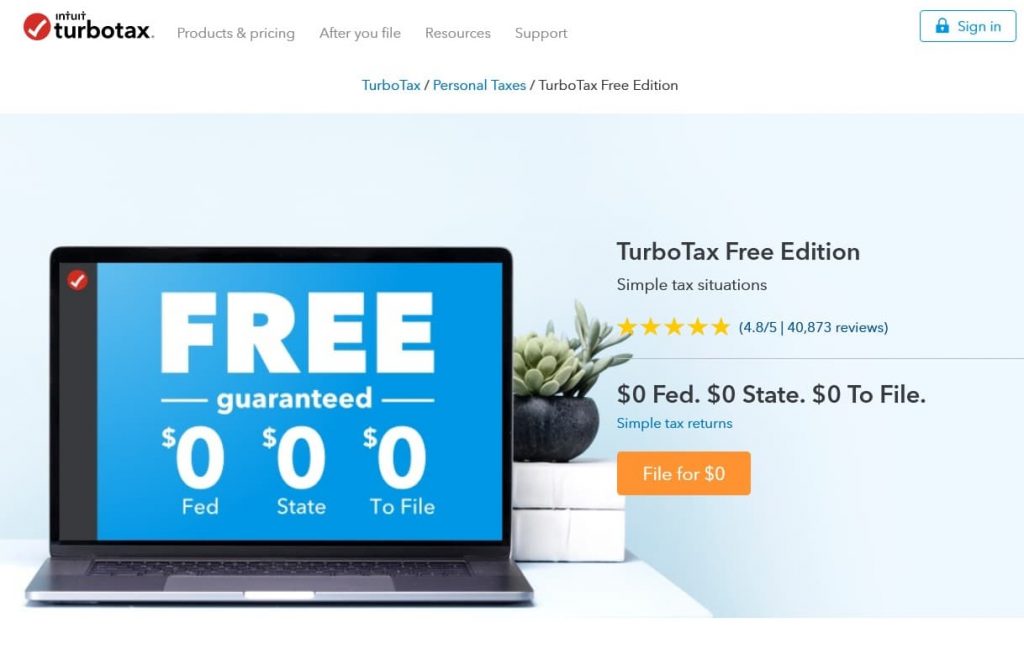

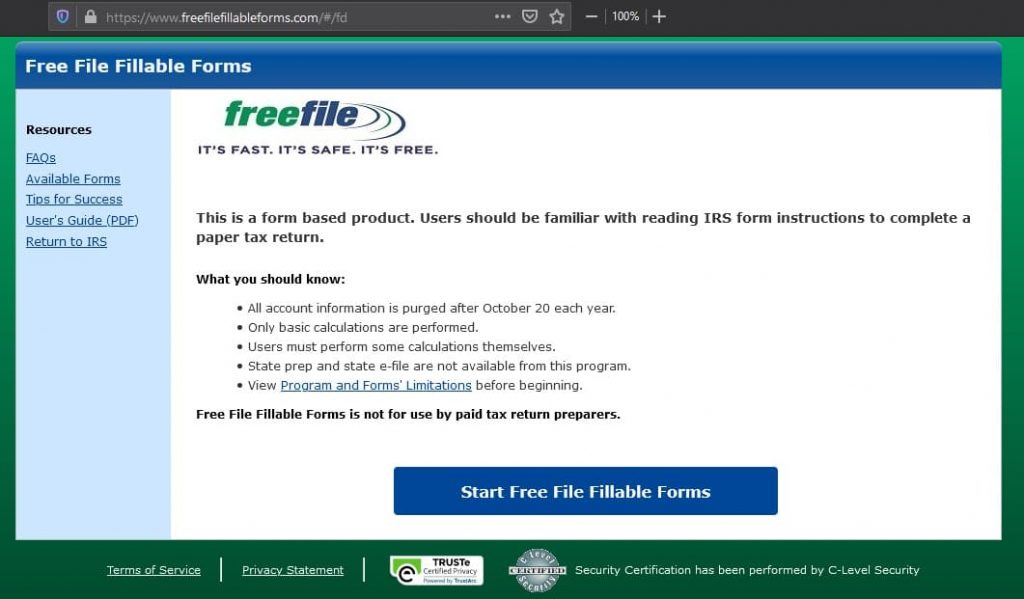

What a big disappointment after having arrived to a welcome page that screams “FREE!” like this one:

Heck, that money didn’t even cover for someone else to do my taxes for me. I had to spend time inputting everything myself.

It was only until I stopped to question everything, that I started searching for another way.

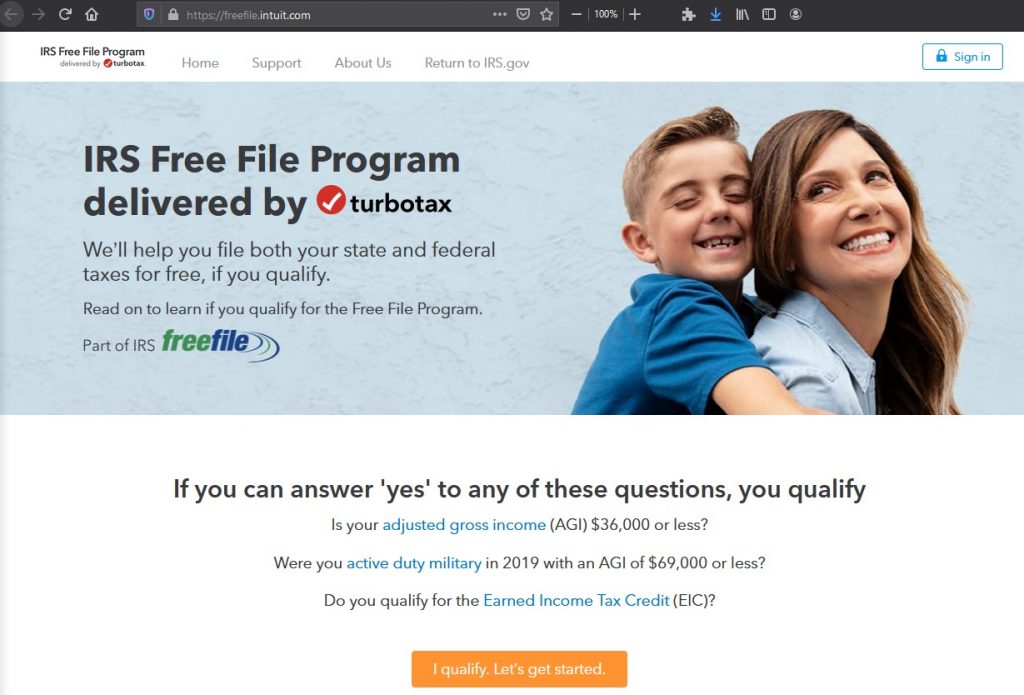

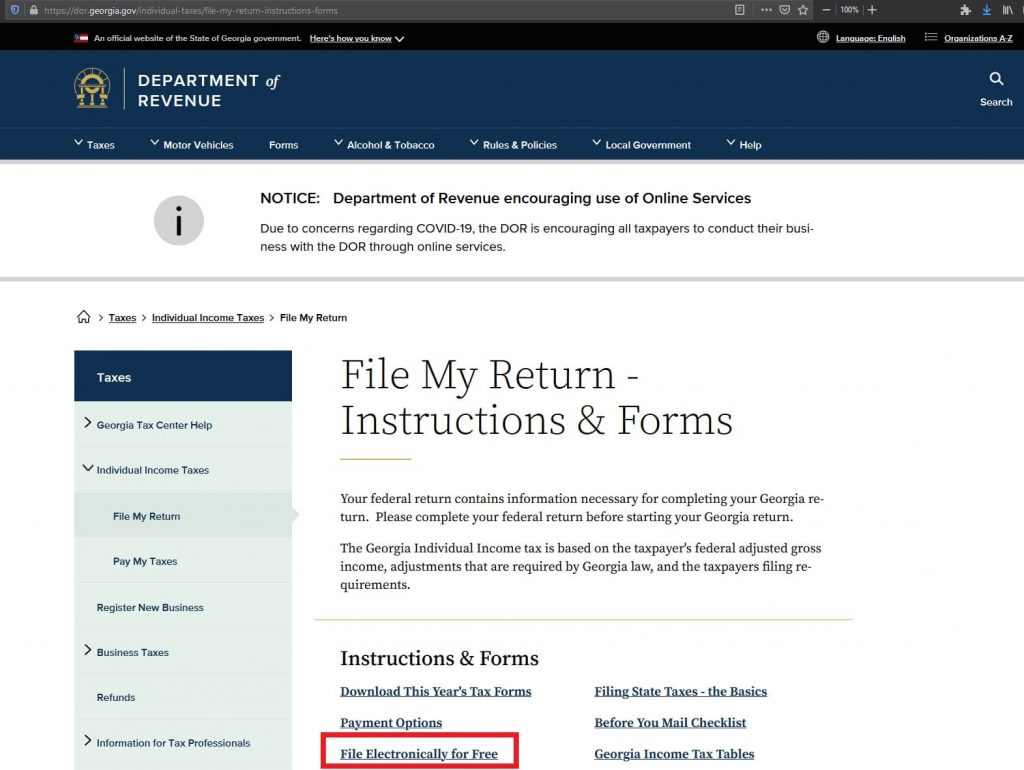

Then I found this:

Lo and behold, I didn’t have to throw away that money in the first place. As a low-income student, I could have gotten access to that same online software service for free.

So point is, to do your own taxes for free online, you need to first find the ultra-rare Free File link.

Next, I’ll show you how to get to it.

Can I Do My Own Taxes for Free?

The easiest way to get to the hidden free file link online tax filing software is to start by going to the IRS.gov page for Free File.

Then select the product that applies to you.

How to File Taxes for Free If You Have Low Income (Online)

For those at any income bracket:

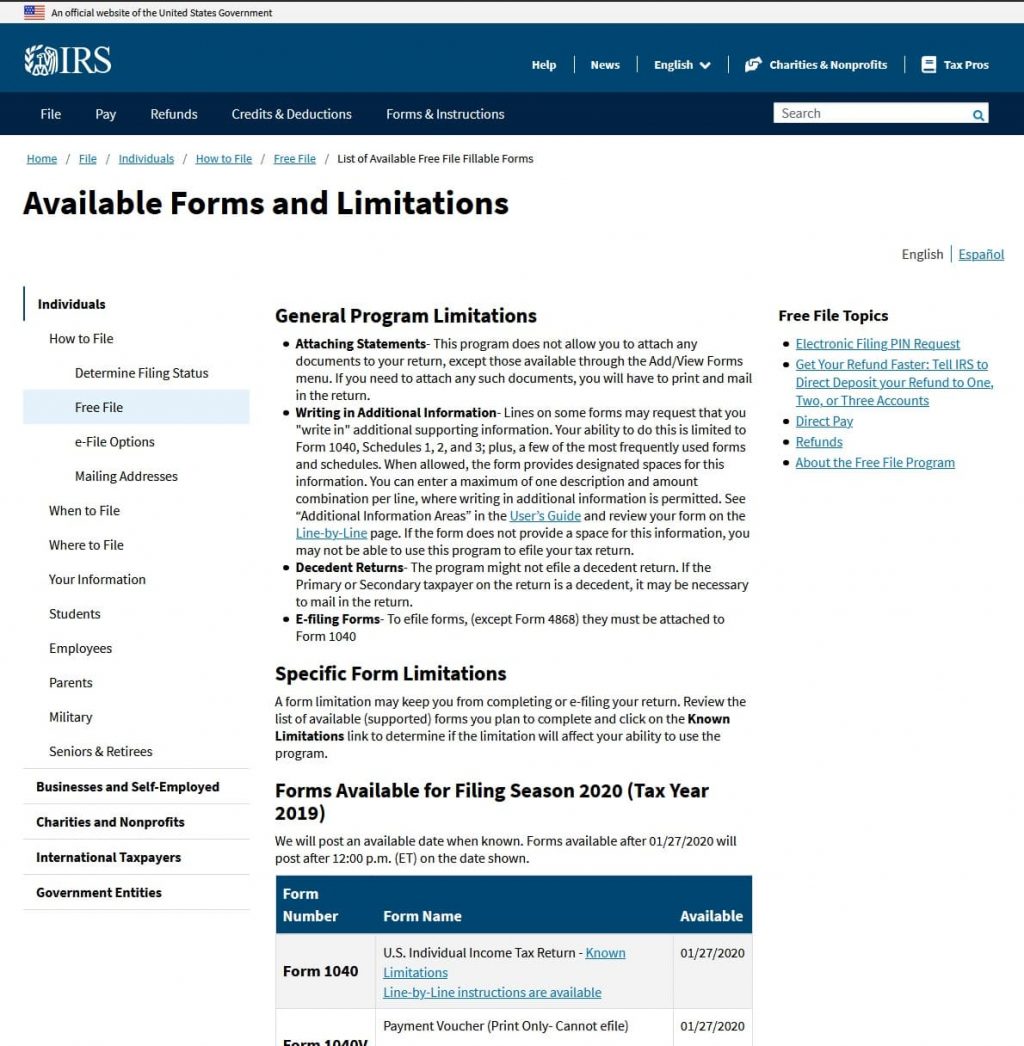

Anyone of any income bracket can download the fillable forms, read the instructions from the official Internal Revenue Service (IRS) website, and file for free (unless you face some odd limitation). [1]

But paper forms aren’t so fun, so let’s look at how to do it online.

If your taxable income is below $69,000:

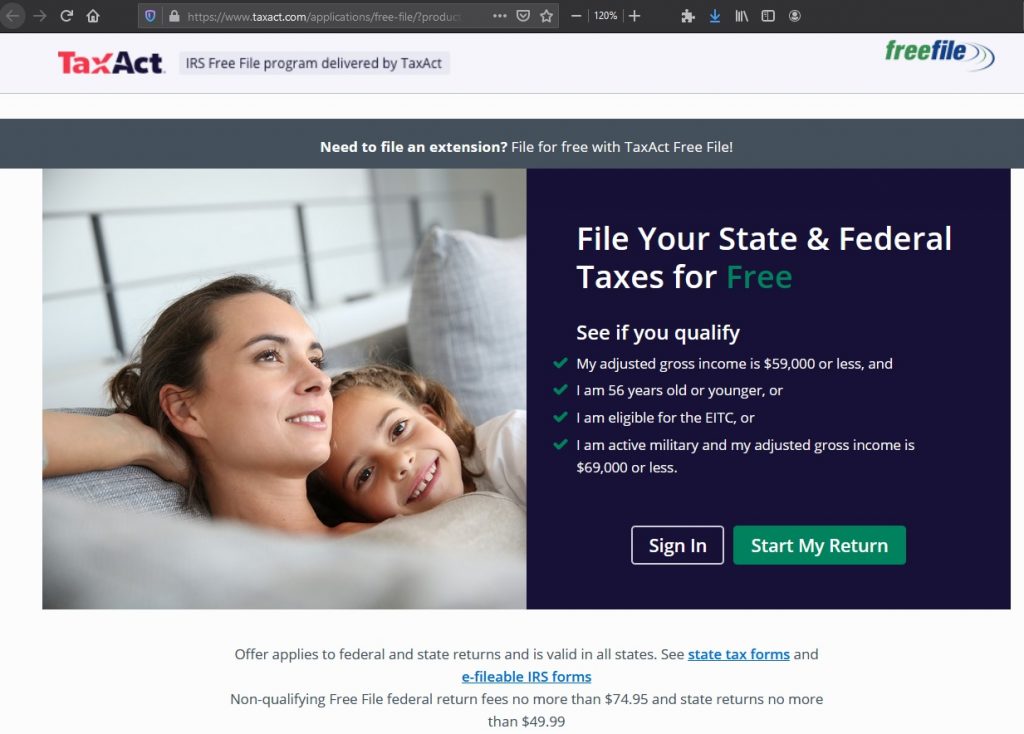

If you have or can meet the adjusted gross income (AGI) limit of $69,000, there may be more than one online site that can walk you through the entire process, federal and state filing, for free and easy.[2]

From those you can look in to, there is TaxAct, FreeTaxUSA, H&R Block, OLT.com, TaxSlayer®, TurboTax, FileYourTaxes.com, ezTaxReturn.com, 1040NOW, and Free 1040 Tax Return.

That’s right, if you qualify, you can use some of the most popular tax preparation software packages for no cost.

First time you hear about this?

Perhaps it’s because big companies like Intuit who owns TurboTax has deliberately made the free version hard to find.[4]

To this day, I have not found the Free File link by looking through their website or search engines.

Oh and there is more, Intuit has spent millions of dollars on federal lobbying to prevent the IRS from creating their own free online tax filing system.[5][6][7]

Which if created, would cut them off as middle men, and save so much money for the people who opt use the free system.

How to File Taxes for Free If You Have High Income (Online)

If your taxable income is above $69,000:

In the case that your adjusted gross income (AGI) is above $69,000 then you can use Free File Fillable Forms.[3]

The major downside of this is that it only includes the federal filing. So you’ll have to look at your state’s department of revenue tax center to figure out whether they have free electronic filing or paper filing available.

As you can see, you only have to pay for the taxes you owe. Not for filing, regardless of your income.

How I Do My Own Taxes For Free (Online)

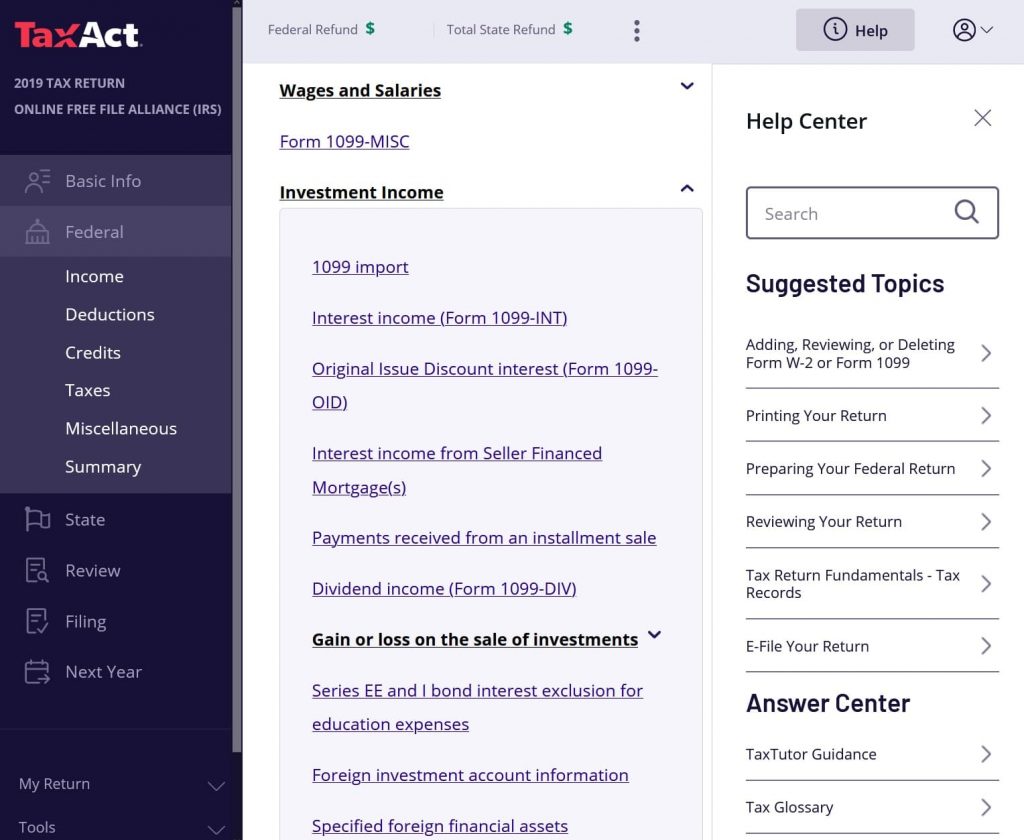

So far I’ve tested Tax Act and I find their interface to be super intuitive and the explanations very helpful.

Can I Do My Own Taxes for Free If I Have Investments?

One of my biggest concerns was whether I could do my own taxes for free if I have investments.

Absolutely, I found it easy to input my stocks, gains and losses, cryptocurrency, and more.

What’s even more awesome, is that you can even input your self-employed business income and expenses, for free, no extra charges. No need to upgrade to the most expensive edition of the software.

Is Doing Your Taxes Yourself Easy?

After you use the Free File link the process is exactly the same as if you were using a fully paid version of the software.

Whether you have a mortgage or have rental property, the online software guides you through everything and lets you jump to the forms you need.

Do You Need a License to Be a Tax Preparer?

Most states do not regulate who can be a tax preparer.

In fact, only 4 states have laws that control who can prepare tax returns for a fee: California, Maryland, New York, and Oregon.[8]

Which means that the person you are paying to do your taxes, might not know anymore than you do!

For those states that do have requirements, they include things like: completing a 60 to 80 hour tax law education course, and paying for a license permit.[9][10]

That’s correct, it does not take a 5 year degree to be able to file your own taxes. You could master it in 2 weeks time. I spent various hours studying the form instructions and learning accounting. Now I don’t depend on anyone to get it done.

Sometimes I forget how to fill out certain boxes when the new year comes around. But that’s no problem, because I know where I can find answers I can trust.

I highly recommend everyone to diversify your skills, and get accounting and tax education. They’re important to help you manage your personal finances effectively.

If I could, I would make it a course requirement for high school students so that no one jumps into a career without it.

Why You Should Hire a Tax Preparer

Professional tax preparers charge based on how organized you are in keeping complete records of your finances and how complex your tax situation is.

If it is the first time doing taxes yourself, you might not trust your own abilities. Perhaps because you’ve been narrowly focused in one career that you’ve missed out on getting smarter at everything else for far too long.

But don’t worry. It’s never too late to learn. What you can do is to try your best at it. As if you had no possible way to afford someone’s help.

After you’re done, compare your tax forms with those done by a professional. Then ask plenty of questions on all the doubts and misconceptions you had.

Sounds familiar? It’s a technique you did all the time at school but probably haven’t internalize as a habit for life.

You learn the quickest by just doing it, and studying your mistakes.

This way, you are getting your moneys worth. By getting the security of having the tax paperwork filed correctly, plus the confidence to do it yourself next year.

For me, my tax situation doesn’t change very much from year to year.

But if it is the first time I’m dealing with a new situation, or if there are new laws and regulations I don’t completely understand, I may consider hiring a certified public accountant (CPA) to learn how it’s done.

Doing Taxes Yourself vs Professional

Can you profit from hiring an entire other human being?

From there on out to decide whether to do it myself or pay a professional, can heavily depend on the opportunity cost.

See what the math has to say.

If the time you spend doing your taxes yourself, means loosing out on earning additional income that is substantially higher than the expenses of outsourcing someone else to do it, then you are better off outsourcing.

And because you’ve learned already learned how your taxes are done, you can verify that the tax professional is actually doing a good job and not ripping you off.

That’s the unfortunate reality of today’s profit-maximization economy. It’s that you can’t just pay someone and expect them to do what is in your best interest.

In today’s world, you gotta wear multiple hats to get ahead.

Why You Should Do Your Own Taxes for Free

Do you have free time to do it yourself?

For those who work 9-To-5, who aren’t directly compensated for working longer, they are better off saving money and doing their own taxes themselves.

If you’ve got the time, why spend it being a couch potato, when you could be richer in the long run?

But the couch is so comfy!

It can be. But for me, I feel way happier when I actively get things done, as opposed to passively entertained by what others have done.

I find it more efficient to do it myself too. I don’t have to spend time researching who to put my trust in, nor do I have to travel, wait, consult, verify, and travel back home.

Plus, if you resist the temptation of spending your money today, you can put that money to work for you and have way more money in the future.

Which can grant you the freedom to spend more of your time the way you like it MUCH earlier on in life.

The Advantage of Doing Your Taxes Yourself

When I taught myself how to file my own taxes, I learned how each deduction was calculated, where each number was coming from.

It was then that I realized,

“WOW! If I allocate my money differently next year, I could reduce my taxable income, and increase next year’s retained income by 15%!”

Doing your own taxes will make you realize that there are more options beyond the ones you have been doing.

It’s how I began to master the art of tax minimization — the art of decreasing your tax liabilities as much as possible.

You’ll learn which choices are more tax efficient. Choices such as:

- Invest for capital gains or for dividends?

- Mutual fund vs ETF?

- How much should I contribute to my 401K, HSA, or IRA retirement accounts to keep most of income?

- Which accounts should I fill up first to grow my money the fastest? Pre-tax cash with tax-free growth, after-tax cash with tax-deferred growth, or after-tax cash with taxed growth?

Investors go CRAZY over ways to achieve a SINGLE percent growth. It’s HARD to increase income.

On the other hand, it is relatively easier to decrease expenses.

And tax expenses is a BIG one.

Tax expenses can go anywhere from 10% to 37% of your taxable income.[11]

With that said, bear in mind that I am not a tax adviser. I am an engineer that thinks up solutions that works in my life and shares them on this blog.

Conclusion

There you have it folks. That’s my guide on how to do your own taxes for free and easy online.

Leave your thoughts in the comment section below. Or join the discussion in the Yoguely Community Forum.

Join our newsletter to get the latest content straight to your inbox.

I’m Aida Yoguely. Thanks for learning with me today. And I’ll see you next time. That’s all folks!

Video

Be sure to subscribe and hit the notification bell to stay tuned for the latest videos.

References

1. ^ (March 6, 2020). “IRS Tax Return Forms and Limitations“. IRS. Retrieved March 16, 2020.

2. ^ “File Your Taxes Online for Free If Your Adjusted Gross Income Was $69,000 or Less“. IRS. Retrieved March 16, 2020.

3. ^ (Jan 27, 2020). “Free File: Do Your Federal Taxes for Free”. IRS. Retrieved March 16, 2020.

4. ^ Justin Elliott, Lucas Waldron (April 22, 2019). “Here’s How TurboTax Just Tricked You Into Paying to File Your Taxes”. ProPublica. Retrieved March 16, 2020.

5. ^ Elliott, Justin (April 9, 2019). “Congress Is About to Ban the Government From Offering Free Online Tax Filing. Thank TurboTax”. ProPublica. Retrieved March 16, 2020.

6. ^ Day, Liz (March 26, 2013). “How the Maker of TurboTax Fought Free, Simple Tax Filing”. ProPublica. Retrieved March 16, 2020.

7. ^ Justin Elliott, Paul Kiel (October 17, 2019). “Inside TurboTax’s 20-Year Fight to Stop Americans From Filing Their Taxes for Free”. ProPublica. Retrieved March 16, 2020.

8. ^ Jodie Fleischer (July 11, 2016) “Georgia requires no training, licensing for tax preparers” WSB-TV Atlanta. Retrieved March 16, 2020.

9. ^ “Registered tax preparers – California Tax Education Council (CTEC)” . State of California Franchise Tax Board. Retrieved March 16, 2020. URL: https://www.ftb.ca.gov/tax-pros/california-tax-education-council.html

10. ^ “Exam Requirements” . Oregon Board of Tax Practicioners. Retrieved March 16, 2020.

11. ^ (November 6, 2019) “IRS provides tax inflation adjustments for tax year 2020″ . Internal Revenue Service. Retrieved March 16, 2020.

- Why Helicopter Money Is Inflationary - 2021-10-09

- How Interest Rates Affect Inflation - 2021-10-08

- How Long Has Inflation Existed? - 2021-10-01